The single-family rental (SFR) market continues to grow and the need for fast, thorough titles is of utmost importance to keep up with the demand. The increase in interest in SFR property investments comes as more individuals have the flexibility to work from anywhere and are looking for larger spaces with outdoor areas.

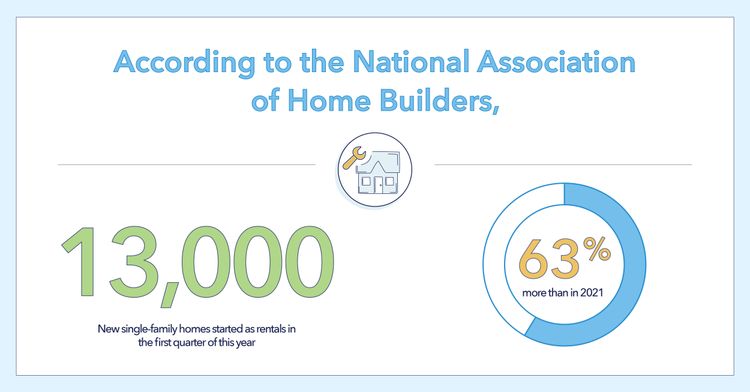

According to the National Association of Home Builders, there were 13,000 new single-family homes started as rentals in the first quarter of this year, up 63% from a year ago. Homes built-for-rent still represent just 5% of the home building market, but that’s up from the 2.7% historical average.¹ In addition, the increase in SFR property volume over the first half of 2022 is being fueled by fast-rising interest rates and tight housing supply.²

With rising interest rates expected to continue to push demand for rentals, the need for efficient SFR solutions is more important than ever. Jason Da Silva, Assistant Vice President, Single-Family Rental Services at ServiceLink, has watched the expansion of this market and provides insight on how ServiceLink works with investors to keep the title process efficient.

Q: What is your role at ServiceLink?

A: I oversee the SFR title department, which includes a team of title curators and title officers with the main goal of helping each of our clients resolve complex title issues to ensure a timely closing.

Q: Tell us about ServiceLink’s experience in the SFR market.

A: SFR property investments have historically been a relatively small part of the overall real estate market, but we have experienced tremendous growth over the last three years. Our centralized model makes a lot of sense for investors, because they can use the same title company regardless of transaction details or locations. Because of our centralized model, there is no need to “reinvent the wheel” every time a client opens a transaction. We have in-house access to underwriters for accelerated decisions and business-based title underwriting decisions. This means that we can provide each client with a streamlined title and closing experience.

Also, we have the backing of Fidelity National Financial – and that stability gives investors a lot of confidence. They know we’ll be there for them through every market cycle.

Q: What trends are your teams seeing in terms of title quality?

A: Because of the lack of inventory, many investors are buying distressed properties to add to their portfolios, which typically come with title issues in the form of probate matters, judgments, code violations, etc. Our team is highly knowledgeable and does a lot of research to quickly get to a resolution. Our curative team is doing the legwork that many title companies push onto the borrower, which helps to expedite the title process.

Lately, we’re seeing a lot of probate complications. To address this, we have a team that focuses specifically on probate issues, so we’re prepared to help investors navigate those waters.

Q: How does ServiceLink effectively meet the needs of investors?

A: ServiceLink has created customized SFR property reports and reviews specific to what investors are looking for. We’re able to align our reporting with their systems to give them real-time information. Our focus is to exceed each of our individual client’s needs – especially when it comes to the data we collect and how we display it. We’re willing to customize our property reports and reviews on a per-client basis, with their individual underwriting requirements in mind.

From the closing perspective, we offer the ability to eClose, which offers investors flexibility in the closing transaction: they can close from their home, their office, or even while traveling. We have the experience and notary panel to help investors integrate eClosing into their workflows.

In addition to customization and technology, my team’s major strength is our diligence and hands-on approach to their work. My team does a ton of research – through online records when possible but also by making phone calls when necessary. Most title companies put that burden on the borrower, but my curative team does as much as possible to make the transaction easy for the investor.

Q: Looking into your crystal ball, what lies ahead for the SFR market?

A: Investors are getting increasingly creative as they focus on different regions – not just the coasts. Now, there’s a lot of focus on the Midwest and a lot of focus on distressed properties. I believe that there’s going to be more inventory available soon, but it’s going to be gobbled up quickly. I know that there will be a lot of continued growth as the market begins to stabilize. Our division has doubled in size within the last year, and we’re likely going to double again as our primary goal is focusing on the service aspect of SFRs to expedite the process. At the moment, we’re working on customizing even further so that our reporting meets the specific SFR property needs of our clients, as well as increasing customization of the title product itself to meet underwriting requirements.

¹Olick, Diana. (2022, June 10). Big landlords jump into homebuilding as demand for single family rentals surges. CNBC.https://www.cnbc.com/2022/06/10/big-landlords-jump-into-the-homebuilding-as-demand-for-single-family-rentals-surges.html

²Conroy, Bill. (2022, June 15). As rates skyrocket, Wall Street single family rental investors see opportunity. HousingWire. https://www.housingwire.com/articles/as-rates-skyrocket-wall-street-single-family-rental-investors-see-opportunity/