As we settle into a new environment for the mortgage industry, the lending market grows increasingly more competitive. Standing out with the exemplary service borrowers now expect could make a difference in helping lenders to meet their goals.

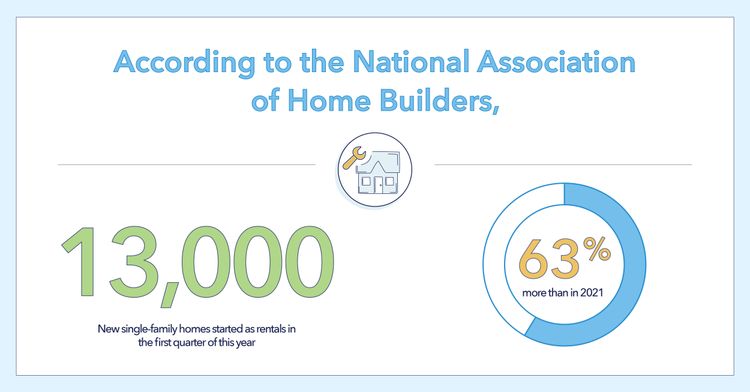

Jim Carney, Vice President, Finance, Sales and Strategy at ServiceLink watches industry trends to help his company better serve lenders and borrowers. “Currently we’re seeing a focus on home equity loans and cash-out refinancing,” says Carney. “Borrowers have higher home values in their homes in this market and lenders have an opportunity to lend based on this increased home equity.”

Home equity loans allow borrowers to take out a specific amount and, depending on the type of loan, start paying on it once the expense is drawn down, balancing the loan against higher home equity rates. Cash-out refinancing is ideal for borrowers who have paid off their mortgage or have their mortgage paid down to a degree well below the home value. Borrowers can take out a loan to refinance and then take cash out to provide funds for needs like reinvesting in the house, debt consolidation, or supporting education expenses.

“In the next six months we expect the market to stabilize at these higher mortgage rates,” says Carney. “Home equity lending is very attractive. Cash-out refinance is dominant relative to what is left in the refinance market. Rates have changed so quickly that some borrowers haven't even caught up with it yet, so activity will continue to grow.”

As lenders struggle to serve clients in this dramatically shifted market of rates bumping back up, many are diminishing workload and scaling back workforces. Suddenly the competition is fierce among lenders as borrowers shop for their best option to meet their financial needs. Their goal: finding the right lender who will serve them through the lifecycle of their loan.

“We're now in a market where lenders need to be as efficient as they can,” says Carney. “Lenders must look at their processes and workflow as they work with less staff. This is the time for lenders to leverage technology, process improvement, and find a way to better serve their clients.

InsightsLending Options in a High-Rate Environment

BlogMore from ServiceLink

Next Post