Decades of experience providing a full suite of home equity services

The industry's complete home equity solution

When homeowners want to tap into their equity, lenders need to be prepared with solutions that not only meet those consumer needs but also build efficiencies into the lending process. ServiceLink provides home equity services including a full spectrum of valuation, title, closing and flood products. We can help you simplify your processes and reduce application-to-close time frames through customized products and services that meet your unique needs and risk requirements.

Home equity title solutions that benefit lenders and borrowers

Instant title technology, property reports, lender loss protection, ALTA title policies and convenient closings are all at your fingertips with ServiceLink’s home equity title solutions. ServiceLink has several decades of title experience backing our products and services. We have processed millions of clear-to-close title transactions, saving lenders and customers time, effort and money. With full ALTA home equity title products, the cost of title can be reduced by as much as 30%.

Customizable home equity title solutions

Our home equity title solution allows lenders to customize products based on risk appetite and borrower needs. Automation is infused through our full suite of title products, enabling us to offer instant property reports and legal and vesting reports. We're able to fulfill a wide variety of client needs with products ranging from title data at point of sale, to uninsured title reports, to ALTA products, and more. Our home equity title solutions also include an efficient escalation path to full ALTA title policies when certain states or higher loan amounts are involved.

Property reports based on title-grade data

ServiceLink has access to 10+ years of national data from reliable title plants, making it possible for us to deliver comprehensive property reports. We can provide a current owner title search, deed information, ownership vesting data, legal descriptions, tax information status, mortgages/deeds of trust, involuntary liens of record, etc.

Equity View: Three reports in one

Equity View provides lenders with all the information they need to make a home equity loan decision in a single report, which includes:

Property Report

Built on title-grade plant and repository data this report includes vesting information, a legal description, any open mortgage or deed of trust information, tax information and the status of any involuntary liens of record.

Automated Valuation Model

The AVM simplifies and expedites the valuations process by providing market value data, property details, satellite photos, and more.

Flood Zone Determination

These materials include a Life of Loan Flood Certificate, Notice to Borrower and aerial images to support the flood insurance assessment.

Partner with a tech-focused industry leader dedicated to getting your borrower to the closing table faster

Read insights from Barry Coffin, managing director, Home Equity Operations, and Sandeepa Sasimohan, vice president, Title Automation. They explain how product innovation can help home equity lenders attract and retain customers.

Closing home equity loans with ServiceLink

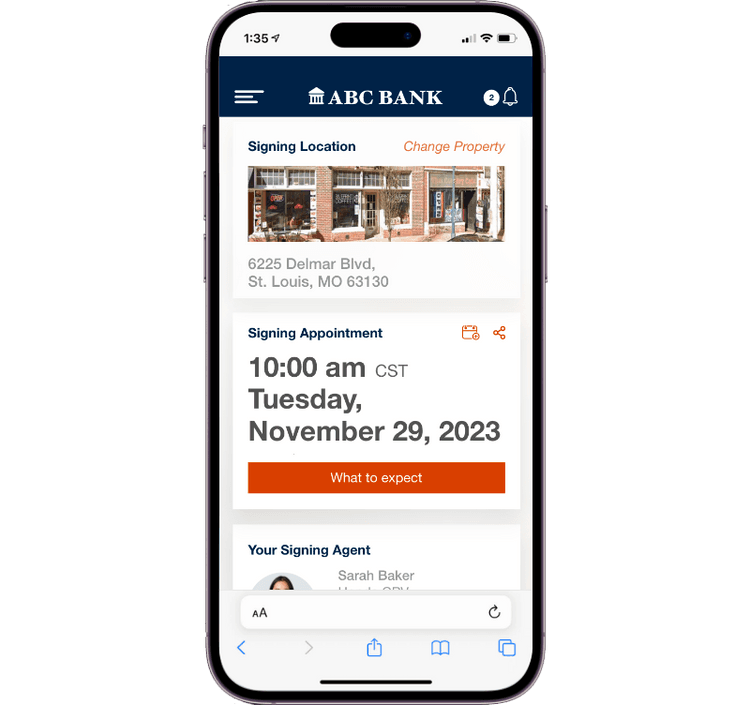

ServiceLink offers closing solutions for wherever you are on your digital journey. Our national panel of notaries and signing agents are available for in-person closings as well as eClosings and other related services. We complement these capabilities with integrated technology that helps get borrowers to their closing date sooner.

When they use the EXOS® Close app to schedule their closing appointment for the exact date and time of their choice, borrowers know exactly what to expect from the process going forward – and you reduce your cycle time by days.

ServiceLink closing products include:

- Traditional In-person Signing

- Remote Online Notarization (RON)

- Remote Ink-signed Notarization (RIN)

- In-person Electronic Notarization (IPEN)

- Hybrid Closings

- Limited Power of Attorney (LPOA) Closings

- Sub-escrow/Closing Protection Letter (CPL)

- Full Escrow CPL

Customized home equity valuation services

From automated valuations to full appraisals, ServiceLink offers a full range of home equity valuation services supported by an extraordinary national appraiser network, dedicated compliance and customer service teams, and industry-leading scheduling technology. We focus on simplifying and expediting the valuations process, as well as ensuring accuracy, for every lender.

ServiceLink valuation products:

- Automated Valuation Model (AVM)

- Property Condition Report

- Desktop Valuation

- Desktop Valuation with Inspection (DVI)

- Residential Evaluation

- Drive-by Appraisal

- Interior Appraisal

Flood solutions for home equity lending

For more than 30 years, ServiceLink Flood has been focused on providing the most current data and advanced technology to deliver accurate, efficient and reliable flood solutions. With ServiceLink Flood’s QuickCheck, know the flood insurance requirements early in the loan process to start the conversation with your borrower about potential flood insurance needs. From there, use InstaQuote to find out potential insurance costs and obtain a Basic Flood Zone Determination, a Life-of-Loan Flood Zone Determination and/or a CertMap®.