Superior Service Powered by Unrivaled Industry Experts

Find Out More

DefaultDefault Overview

ServiceLink’s Default Services division provides its investor, mortgage servicing and specialized servicing customers with complete services and technology that span the entire default lifecycle, offering them complete start-to-finish default management from a single source. By providing comprehensive services throughout the life of the loan, we are able to ensure that our customers receive the highest quality service backed by our best-in-class technology and unrivaled team of dedicated industry experts.

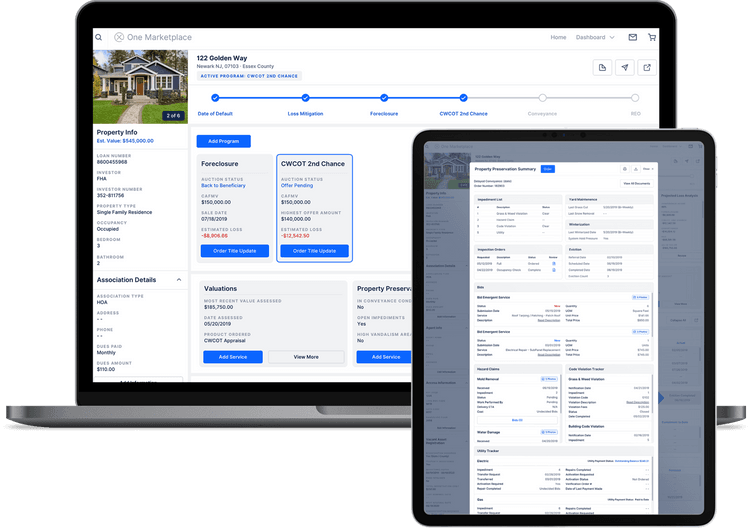

Asset Decisioning ToolEXOS One Marketplace

Servicers now have access to unprecedented technology and visibility of portfolios to efficiently manage assets by leveraging a proprietary mix of AI, machine learning, and data analysis with EXOS One Marketplace®.