Providing scalable, compliant eClosing solutions for lenders and borrowers

Why ServiceLink for your eClosing needs

We developed our eClosing solution by combining our decades of mortgage closing expertise with our in-house, cutting-edge mortgage technology. As a result, we’re prepared to help lenders adopt eClosing options to accelerate origination and improve the borrower experience. We offer auditable and compliant documentation and support, as well as a platform enabling the delivery and signing of all requested documents.

Today, we can readily perform 100% of your desired eClosings with our in-house ServiceLink-managed panel. And, because our solution is versatile, we offer virtual closing options for all 50 states. Our solution supports remote online notarization (RON), hybrid closings, remote ink-signed notarization (RIN), in-person electronic notarization (IPEN), and virtual closings enabled by limited power of attorney (LPOA). By partnering with ServiceLink, you can offer your borrowers a virtual closing regardless of location.

How eClosing with ServiceLink will help you close faster

We know that speed is important to your bottom-line – and to your borrower. In fact, 50% of borrowers surveyed said speed was an important factor in their refinance process, and virtual closings accelerate the closing process. eClosings drastically reduce post-close issues, removing friction from your workflows.

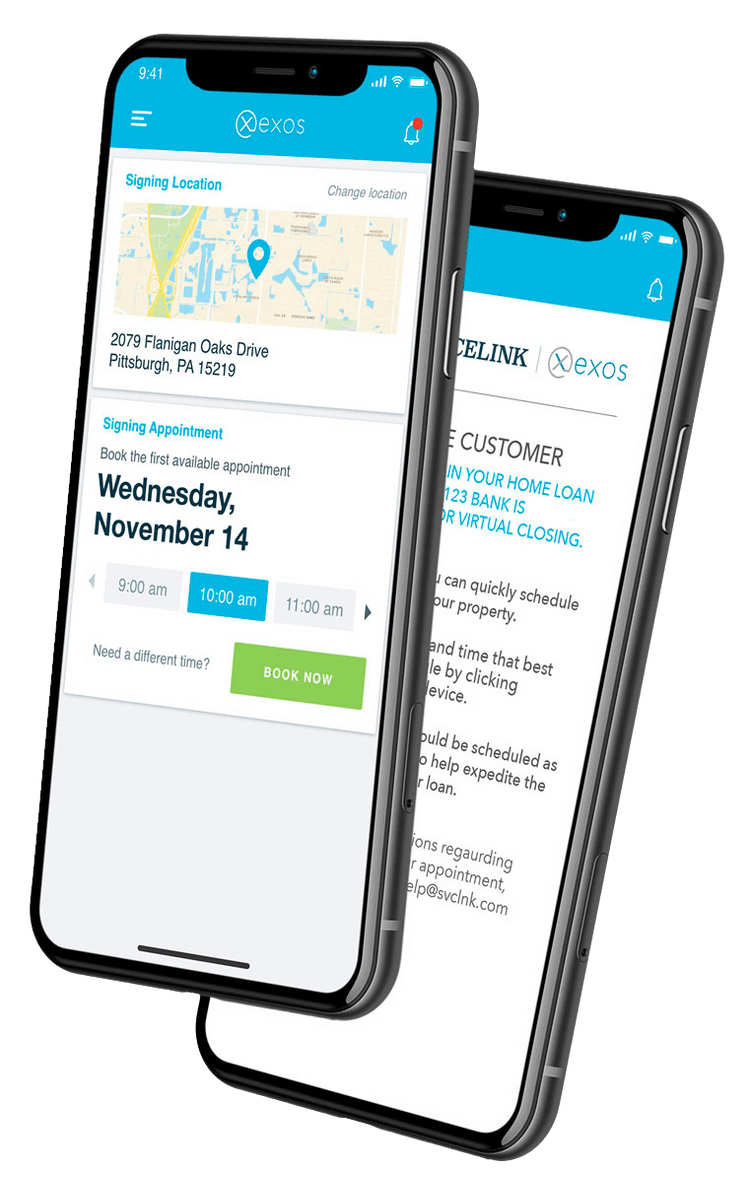

ServiceLink infuses additional speed into the eClosing process with our EXOS® Close scheduling solution. With EXOS Close, lenders and consumers eliminate uncertainty and wasted time in virtual waiting rooms by scheduling their closing appointment for the exact date and time of their choice. They instantly receive appointment confirmation and their signing agent’s name, contact, information and photo.

Combining eClosing with ServiceLink’s EXOS® Title

Combining eClosing with ServiceLink’s instant title offering, EXOS Title, will allow you to get to the closing table faster. EXOS Title delivers instant title commitments without sacrificing proven search and examination methods and can complement your eClosing workflows.

How eClosing improves the borrower experience

Did you know that 89% of consumers surveyed agreed that eSignatures are easy and convenient? Furthermore, 88% agree that eSignatures save time in large transactions like obtaining a mortgage and 79% expressed interest in using eSignatures specifically for mortgage applications. Our eClosing solutions help you meet consumer demand by eliminating the need for an in-person closing event and increase transparency by allowing your borrowers to review and authorize their closing documents wherever they are. Partner with ServiceLink to meet your borrowers where they are: in-person, virtually, or a combination.

Alternatives to traditional in-person closings

ServiceLink supports various virtual closing options in order to provide lenders solutions that work for them and their borrowers.

RON

The closing is conducted during a video session between a ServiceLink notary and a borrower. The lender simply uploads the closing package into the RON platform, without disrupting their workflow. The borrower initiates the RON session at the exact date and time of their choice. During the session, the ServiceLink notary walks the borrower through the closing documents, the borrower signs them, and the notary eNotarizes them.

IPEN

In this type of virtual closing, the borrower eSigns the closing package in-person with a notary. Then, the notary eSigns and eNotarizes the applicable documents.

RIN

The borrower and notary video conference. The borrower physically signs documents while the notary observes via video. The borrower then mails the signed documents to the notary, who physically notarizes them upon receipt.

Hybrid Signings

ServiceLink supports a variety of hybrid signing options, according to our lenders’ unique needs. We offer hybrid-RON signings, as well as hybrid-wet sign closings. With these options, the borrower reviews and signs part of the closing package prior to the closing event.

LPOA

To kickstart the LPOA closing process, the borrower physically signs a LPOA with a notary and sends it to ServiceLink. Then, during a video session, a signing representative signs the closing documents on the borrower’s behalf.

Implementing eClosing options

Seamlessly plug and play into your existing closing processes as you expand your eSigning offerings. Our vendor-agnostic solutions are compatible with any eSign or remote notarization platform.

We know that today’s lenders have options. To conduct their virtual closings, lenders can either work with their title provider and that provider’s signing agent panel or opt for a closed platform with its own signing agents. Read this article to learn about the benefits of eClosing with your title provider.